Clients

Fund Administrators

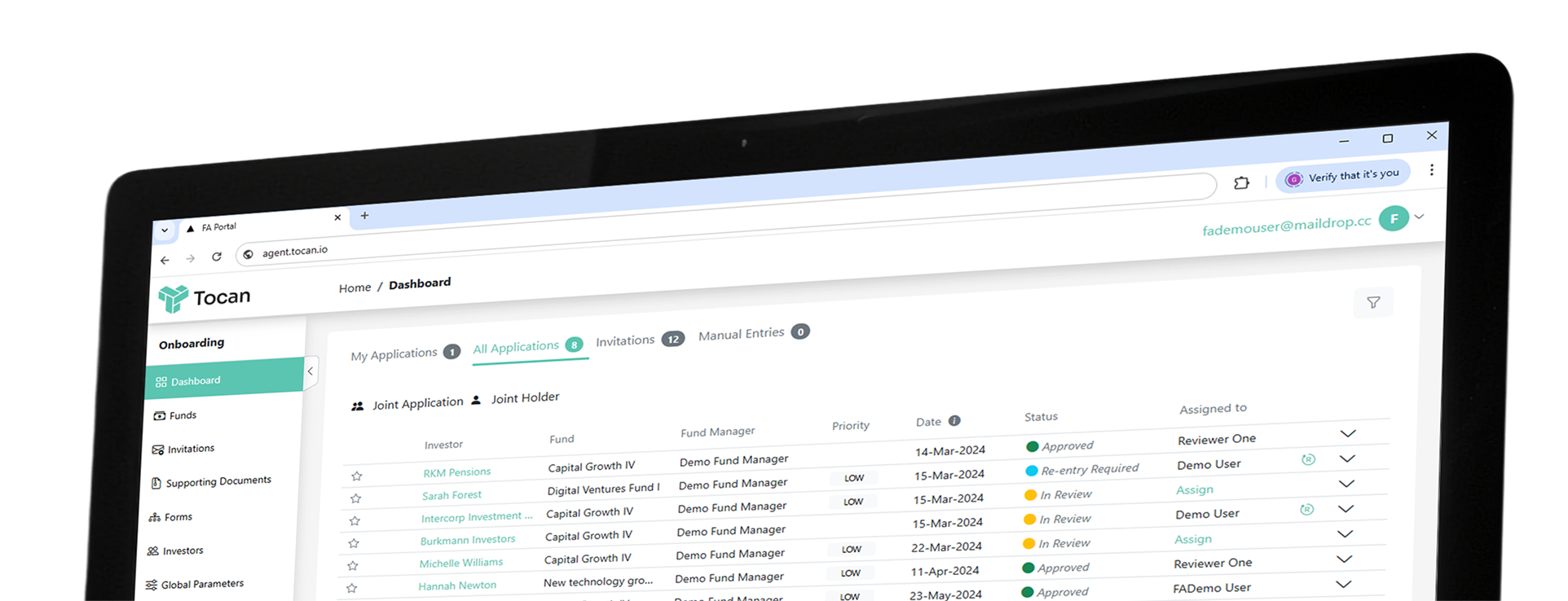

Fund administrators are expected to deliver faster onboarding, better data, and seamless investor experiences – all while reducing cost and risk. Tocan equips fund administrators with the digital infrastructure to support fund managers more effectively and operate at scale with less friction.

Challenges

Current operating models push fund administrators into reactive mode – burdened by manual tasks, inconsistent investor journeys, and growing compliance risk. Tocan replaces this with a unified digital infrastructure that reduces cost, increases control, and enables scale without complexity.

Manual Processes Inflate Operational Costs

High-touch KYC/AML processes and fragmented workflows increase overhead and reduce margin.

Inconsistent Experiences Create Rework and Exceptions

Disparate onboarding models force administrators to handle edge cases manually – increasing risk and delaying time to activation.

Data Fragmentation Undermines Control and Compliance

Siloed systems make it harder to manage data, audit trails, and reporting – exposing firms to regulatory and reputational risk.

Outdated Technology Blocks Scale and Efficiency

Legacy tools can’t adapt to new distribution models, forcing expensive workarounds that slow down growth and innovation.

Tocan Benefits

Tocan empowers fund administrators and managers to scale smarter – reducing operational costs, automating compliance, and streamlining investor interactions.

With a modern, modular platform, Tocan replaces fragmented processes with efficiency, reduces tech debt, and delivers a digital experience your clients want.

It’s not just about automation – it’s about creating infrastructure that drives growth, protects margin, and evolves with your business.

Drive Operational Efficiency and Reduce Cost-to-Serve

Tocan automates manual processes across onboarding, compliance, and investor servicing – cutting unit costs, reducing rework, and protecting profitability in a market squeezed by fee compression.

Scale Compliance Without Scaling Headcount

By automating KYC/AML workflows, Tocan enables operations teams to handle higher volumes without resource strain – all while maintaining robust regulatory compliance.

Simplify Operations with Consolidated Processes and Best in Class Data Management

Tocan integrates data collection, validation, and storage into one platform, improving risk oversight, auditability, and long-term scalability without increasing system complexity.

Deliver a Frictionless, Client Centred Experience

With an intuitive interface and guided workflows, Tocan reduces touchpoints, simplifies investor interactions, and drives higher satisfaction across all user groups.

Ensure Long-Term Resilience Through Modern Architecture

Tocan is built to integrate with evolving operating models – future proofing your stack and enabling seamless transitions away from legacy infrastructure.

Enhance Brand Presence with Tailored, White Label Experiences

Branded portals and configurable experiences allow clients to stand out in market while delivering a seamless digital experience aligned with their brand identity.

Adapt Without Overhead Through a Flexible, Standardised Framework

Tocan’s framework balances flexibility and standardisation – removing the need for costly custom builds while still adapting to each client’s unique processes.